Risk Management

Risk Management

Risk Identification

The only certainty is uncertainty

- Risk management helps to understand potential risks

- Identify weaknesses before they become an issue

An important part of any organization

- Growth brings risk

- It’s useful to get ahead of any potential problems

Risk management

- Manage potential risk

- Qualify internal and external threats

- Risk analysis helps plan for contingencies

Performing a risk Assessment

Not all risk requires constant evaluation

- Or it might be required to always assess the amount of risk

One-time

- The assessment may be part of a one-time project

- Company acquisition, new equipment installation, unique new security threats, etc.

Continuous assessments

- May be part of an existing process

- Change control requires a risk assessment as part of the change

Ad HOC Assessment

An organization may not have a formal risk assessment process

- Perform an assessment when the situation requires

CEO is back from a conference

- Wants to know if the organization is protected from a new attack type

A committee is created, and the risk assessment proceeds

- Once the assessment is complete, the committee is disbanded

- There may not be a need to investigate this specific risk again

Recurring Assessment

Recurring assessments

- The evaluation occurs on standard intervals

An internal assessment

- Performed every three months at the beginning of the quarter

A mandated risk assessment

- Required by certain organizations

- Some legal requirements will mandate an assessment

- PCI DSS requires annual risk assessments

Risk Analysis

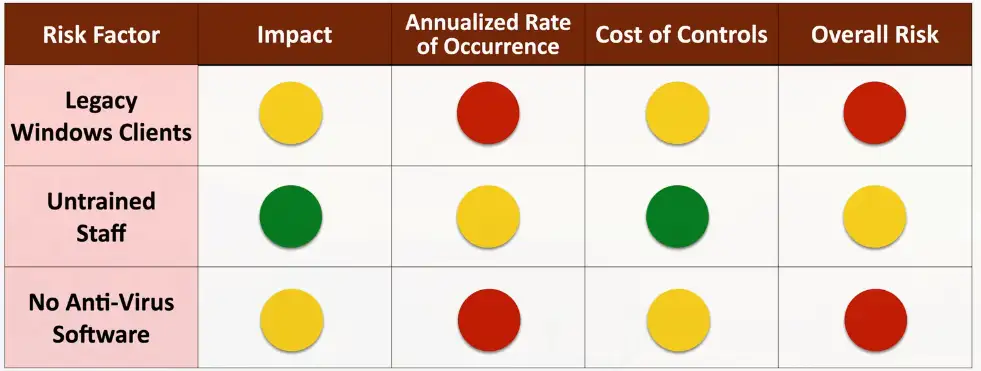

Qualitative Risk Assessment

Identify significant risk factors

- Ask opinions about the significance

- Display visually with traffic light grid or similar method

ARO (Annualized Rate of Occurrence)

- How likely is that a hurricane will hit? In Montana? In Florida?

Asset value (AV)

- The value of asset to the organization

- Includes the cost of the asset, the effect of company sales, potential regulatory fines, etc.

Exposure factor (EF)

- The percentage of the value lost due to an incident

- Losing a quarter of the value is

.25 - Losing the entire asset is

1.0

SLE (Single Loss Expectancy)

- What is the monetary loss if a single event occurs?

Asset value (AV) x Exposure factor (EF)Laptop stolen = $1000 (AV) x 1.0 (EF) = $1000 (SLE)

ALE (Annualized Loss Expectancy)

Annualized Rate of Occurrence (ARO) x SLESeven laptops stolen a year (ARO) x $1000 (SLE) = $7000

The business impact can be more than monetary

Quantitative vs. qualitative

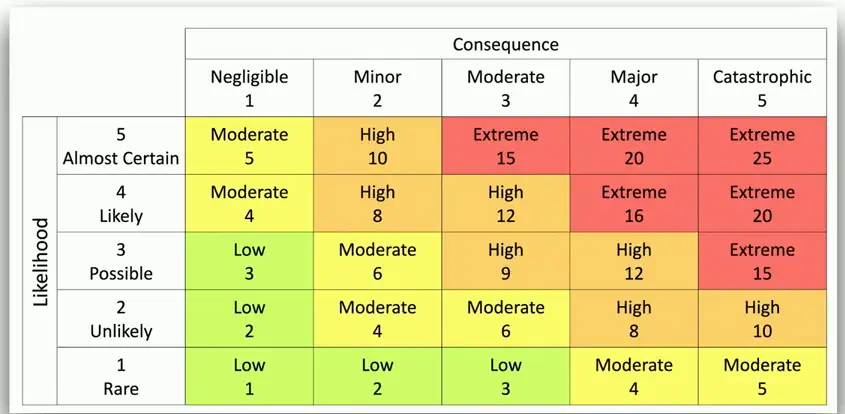

Impact

Life

- The most important consideration

Property

- The risk to buildings and assets

Safety

- Some environments are too dangerous to work

Finance

- The resulting financial cost

Likelihood and Probability

Risk likelihood

- A qualitative measurement of risk

- Rare, possible, almost certain, etc.

Risk probability

- A quantitative measurement of risk

- A statistical measurement

- Can be used based on historical performance

Often considered similar in scope

- Can be used interchangeably in casual conversation

Risk Appetite and Tolerance

Risk appetite

- A broad description of risk-taking deemed acceptable

- The amount of accepted risk before taking any action to reduce that risk

Risk appetite posture

- Qualitative description for readiness to take risk

- Conservative, neutral, and expansionary

Risk tolerance

- An acceptable variance (usually larger) from the risk appetite

Risk appetite example:

- A highway’s speed limit

- Government authorities have set the speed limit

- The limit is an acceptable balance between safety and convenience

Risk tolerance example:

- Drivers will be ticketed when the speed limit is violated

- Ticketing usually occurs well above the posted limit

- This tolerance can change with road conditions, weather, traffic, etc.

Risk Register

Every project has a plan, but also has risk

- Identify and document the risk associated with each step

- Apply possible solutions to the identified risks

- Monitor the results

Key risk indicators

- Identify risks that could impact the organization

Risk owners

- Each indicator is assigned someone to manage the risk

Risk threshold

- The cost of mitigation is at least equal to the value gained by mitigation

Risk Management Strategies

Accept with exemption

- A security policy or regulation cannot be followed

- May be based on available security controls, size of the organization, total assets, etc.

- Exemption may need approval

Accept with exception

- Internal security policies are not applied

- Monthly security updates must be applied within 3 calendar days

- The monthly updates cause a critical software package to crash

- An exception is made to the update timeframe

Avoid

- Stop participating in a high-risk activity

- This effectively removes the risk

Mitigate

- Decrease the risk level

- Invest in security systems

Risk Reporting

A formal document

- Identifies risk

- Detailed information for each risk

Usually created for senior management

- Make decisions regarding resources, budgeting, additional security tasks

Commonly includes critical and emerging risks

- The most important consideration

Business Impact Analysis

Recovery

Recovery time objective (RTO)

- Get up and running quickly

- Get back to a particular service level

- You’re not up and running until the database and web server are operational

- How long did that take?

Recovery point objective (RPO)

- How much data loss is acceptable?

- Bring the system back online; how far back does data go?

- The database is up, but only provides the last twelve months of data

Meantime to repair (MTTR)

- Average time required to fix an issue

- This includes time spent diagnosing the problem

- An important metric for determining the cost and time associated with unplanned outages

Mean time between failures (MTBF)

- The time between outages

- Can be used as a prediction or calculated based on historical performance

Total Uptime/Number of Breakdowns- Statistically plan for possible outages